The past twenty years suggest that China wants to increase its economic and political reach at the expense of the U.S. Our recent paper examines if this is true by investigating the effects of U.S. sanctions on Chinese overseas foreign direct investment (FDI). We find that Chinese state firms are more likely to invest in states threatened or targeted with U.S. sanctions relative to Chinese private firms because they have the Chinese government’s backing. They are also larger in number and size, motivating higher-risk investment. In sum, Chinese state firms’ busting of U.S. sanctions seems to enhance China’s influence abroad and produce the opposite effect for the U.S.

Why Do Sanctions Matter?

For decades, the U.S. has used economic sanctions (e.g., foreign aid, trade, or FDI) against targeted countries. The goal of U.S. sanctions is to apply pressure to the targeted states and induce foreign policy changes. Unlike the U.S., China has generally opposed issuing sanctions. However, that does not mean that China is uninterested in throwing its weight around. In fact, we argue that China acquires economic and political influence by busting U.S. sanctions, supplying resources to targeted states and limiting the effectiveness of U.S. sanctions.

Why Do Chinese State Firms Invest More in U.S. Sanctioned Countries than Chinese Private Firms?

Chinese overseas FDI involves both public and private firms, who seem to invest differently. We contend that Chinese state firms tend to ignore political risk, because they have the Chinese government’s backing. When the U.S. issues sanctions, Chinese state businesses replace U.S. firms, forced to leave by the U.S. government, offering benefits to China and reducing economic prospects for U.S. firms. Chinese state businesses, based on their large size and number of firms, also pressure host governments to adopt policies favorable to China that forges common bonds between China and host states. Thus, Chinese state enterprises replacing U.S. firms are a win-win for China and a lose-lose for the U.S.

Conversely, Chinese private firms heed political risk concerns because they receive minimal financial support from the Chinese government and pay higher tax rates at home than Chinese state enterprises. Chinese private firms also are usually smaller in size and have less leverage with host states. Because of their economic disadvantages and weaker influence with host-countries, Chinese private firms tend to avoid sanctioned or threatened states.

The Democratic Republic of the Congo (DRC), Mauritania, and Chinese State Firms

The DRC and Mauritania appear to show that U.S. sanctions attract Chinese state firms more than private ones. Looking at the DRC, following the U.S. imposition of sanctions in 2010, FDI fell from private U.S., Chinese, and other countries’ firms. However, Chinese state enterprises invested hundreds of millions of dollars in late 2010, and reinvested funds during the sanction years. Likewise, Mauritania incurred U.S. sanctions in 2008,with the U.S. suspending bilateral development assistance, and Chinese private firms staying on the sidelines. But not Chinese public firms, who invested (and reinvested) hundreds of millions. Chinese state firms seemed unfazed or even relished the investment opportunities presented in sanctioned countries.

Results

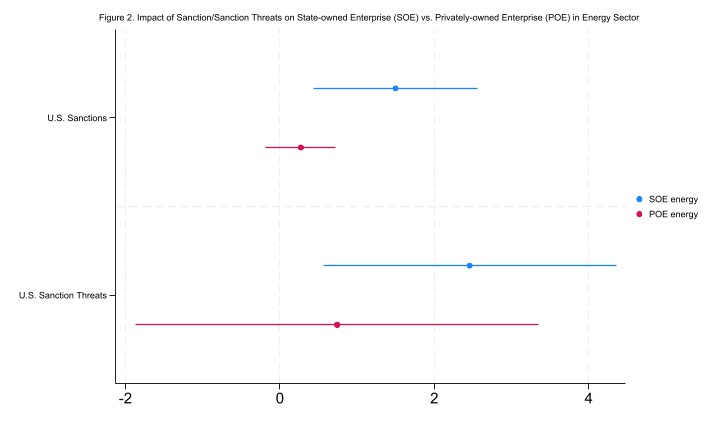

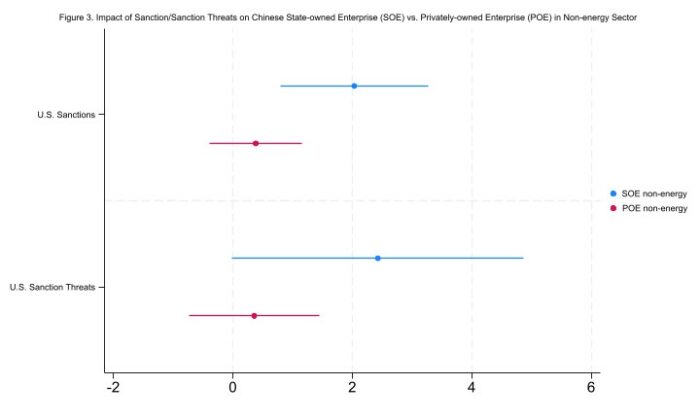

Using statistical analysis for 112 developing countries from 2005-2015, we find that Chinese state firms increase their investment in sanctioned countries by approximately 1000 percent and in countries threatened by sanctions by nearly 2400 percent. We also find that the investment sector, such as energy vs. non-energy, makes little difference in the results. In contrast, Chinese private firms appear less interested in investing in threatened or sanctioned countries, no matter the investment sector.

Implications

Our work shows that companies that have the Chinese government’s backing are more capable and willing to take on the risks of investing in U.S.-sanctioned countries, providing insights for why and how sanctions-busting occurs. The research also suggests that the reason sanctions-busting arises is much more political than in the past, where economics played a larger role. The finding that private sector firms are under increasing pressure from the economic statecraft strategies wielded by the world’s two leading economic powers, also reinforces the importance of politics on risk. Importantly, our study engages the politics of U.S.-Chinese relations

This blog piece is based on the forthcoming Journal of Politics article “The Effects of US Sanctions on Chinese Public and Private Overseas Foreign Direct Investment” by Glen Biglaiser, David Lektzian, and Kelan (Lilly) Lu.

The empirical analysis has been successfully replicated by the JOP and the replication files are available in the JOP Dataverse

About the Authors

Glen Biglaiser (gbiglais@gmail.com) is a professor in the Department of Political Science at the University of North Texas. He is the author/co-author of books at University of Notre Dame and University of Michigan Press and has published articles in journals including Comparative Political Studies, International Organization, and International Studies Quarterly.

David Lektzian (David.Lektzian@ttu.edu) is a professor in the Department of Political Science at Texas Tech University. His articles have appeared in a range of journals including the American Journal of Political Science, International Organization, International Studies Quarterly, the Journal of Conflict Resolution, and the Journal of Peace Research.

Kelan (Lilly) Lu (lu3@mailbox.sc.edu) is an associate professor in the Department of Political Science at the University of South Carolina. She is author of a book at the University of Michigan Press and has published articles in journals including Foreign Policy Analysis, Studies in Comparative International Development, and the Journal of Asian and African Politics.