In the realm of climate policy, carbon taxation stands out as an economically important yet politically contentious instrument. Despite widespread support from environmental economists for its effectiveness in reducing greenhouse gas emissions, the political feasibility of carbon taxes is not so straightforward. These political challenges stem from the inherent distributional consequences of carbon taxes through their impact on individual.

Our recent study sheds new light on this tension by examining how citizens in Germany and the United States form their preferences towards carbon taxation, focusing on the interplay between personal economic concerns and broader, other-regarding motivations.

Economic Self-Interest as a Driving Force

Our findings reveal a dominant influence of economic self-interest on public attitudes towards carbon taxation. Across both countries, individuals primarily assessed the carbon tax in terms of its direct impact on their personal income. This result challenges the notion that other-regarding motivations, such as fairness or environmental concern, are the primary drivers of public opinion on climate policies. Instead, it underscores the centrality of pocketbook considerations in shaping support for carbon taxation.

Cross-National Differences in Redistribution Preferences

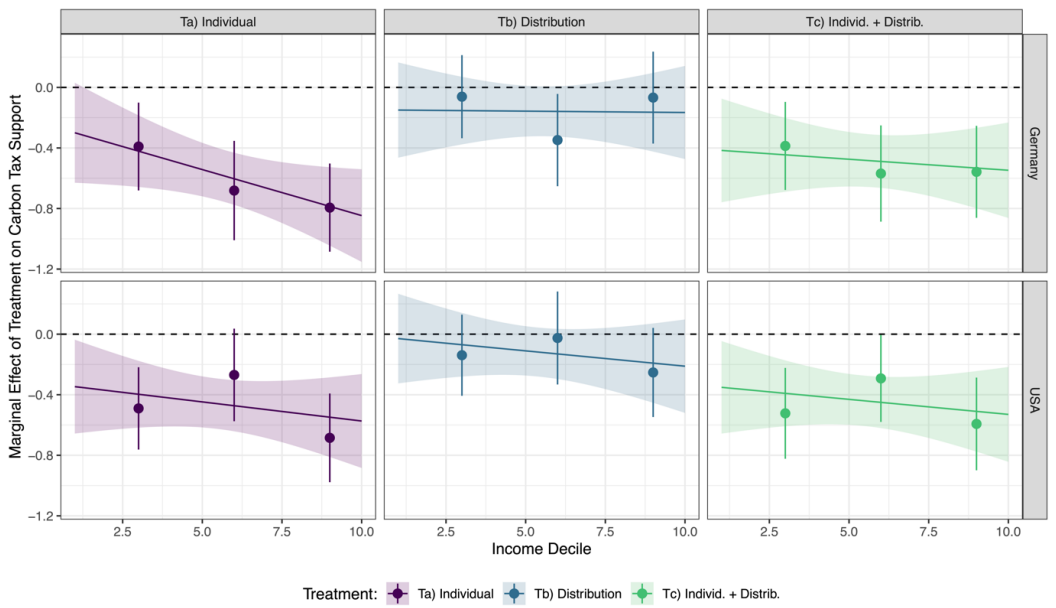

An intriguing aspect of our study is the observed cross-national differences in responses to redistributive policy designs. German respondents, particularly those with higher incomes, displayed a greater receptiveness to redistributive aspects of carbon tax policies. In contrast, high-income Americans, including Democrats who typically advocate for environmental policies, showed decreased support for carbon taxation when confronted with its personal financial implications. This highlights the varying national contexts that shape public perceptions of fairness and redistribution in climate policy.

Policy Design and Public Support

Our research also delves into the critical role of carbon tax policy design in influencing public support. Different approaches to revenue recycling, such as tax rebates, significantly affect public attitudes. In the U.S., low-income groups showed increased support for carbon taxation when it included a general tax rebate, while high-income groups reacted negatively to such redistributive measures. Conversely, in Germany, high-income individuals were more supportive of carbon taxes with rebates when aware that it benefits low-income groups. These findings illustrate the complex interplay between policy design and public preferences, emphasizing the need for nuanced approaches in different national contexts.

Partisanship and Income Information

Political partisanship, often thought to be a predictor of environmental policy preferences, does not consistently determine responses to carbon tax costs. For instance, our study found that high-income Democrats in the U.S., usually supportive of green policies, reduced their support for carbon taxation upon learning about its impact on their income, aligning their views with those of Republicans. This suggests that economic considerations can override ideological predispositions in the context of climate policy.

Policy Design and Political Feasibility

The political feasibility of carbon taxes, therefore, hinges on the balance between their economic effectiveness and public acceptability. Our findings indicate a significant gap between general support for climate policies and informed support when the economic implications of such policies are made explicit. This gap presents a formidable challenge in designing carbon taxes that are both effective in mitigating climate change and politically feasible. It also points to the importance of transparent and targeted communication about the economic aspects of climate policy to bridge this understanding gap.

Conclusion

Our study contributes to the ongoing discourse on climate policy by highlighting the predominant role of economic self-interest in shaping public preferences for carbon taxation. It underscores the necessity of considering both economic impacts and policy design intricacies in fostering public support for climate policies. As the world grapples with the urgent need to address climate change, understanding these dynamics becomes essential for developing politically viable and effective policy responses.

Note

Figure: How information about the effect of carbon taxation upon incomes affects support for carbon taxation, conditional upon income. Lines indicate linear interaction effect estimates, with shaded 95% confidence intervals. Points indicate estimates from the binning estimator, where treatment effects are allowed to vary by three partitions of the income (terciles), with vertical lines indicating 95% confidence intervals.

This blog piece is based on the forthcoming Journal of Politics article “How Do Pocketbook and Distributional Concerns Affect Citizens’ Preferences for Carbon Taxation?” by Liam F. Beiser-McGrath and Thomas Bernauer.

The empirical analysis has been successfully replicated by the JOP and the replication files are available in the JOP Dataverse

About the Authors

Liam F. Beiser-McGrath is an Assistant Professor in International Social and Public Policy in the Department of Social Policy, Associate of the Grantham Research Institute on Climate Change and the Environment, and Affiliate of the Data Science Institute at the London School of Economics and Political Science. His research focuses on the political economy of climate change, using experimental research designs and machine learning. For more information, visit his website.

Thomas Bernauer is a Professor of Political Science at ETH Zurich. He and his research group are based at the Center for Comparative and International Studies, a joint institution of ETH Zurich and the University of Zurich, as well as ETH Zurich’s Institute of Science, Technology, and Policy. In his research and teaching, Thomas Bernauer focuses on international environmental and economic issues. For more information, visit his website.